How to Build ₹2 Crore Corpus in 20 Years Through SIP: A Smart Plan for Child’s Future

20-Year SIP to ₹2 Crore: Complete Guide for Young Parents

If you’re 25–30 and planning for your child’s higher education and marriage, this guide shows the exact monthly SIP to target ₹2 Crore in 20 years—plus fund categories and a model allocation.

Why a 20-Year Horizon Matters

Compounding thrives on time. Education costs that are ₹25 lakh today can reach ₹80 lakh–₹1 crore in two decades. Wedding budgets of ₹20 lakh can grow to ₹60–70 lakh. Targeting a ₹2 crore corpus helps you cover higher studies, overseas education, and marriage without debt.

Run your numbers with our SIP Calculator or book a free call.

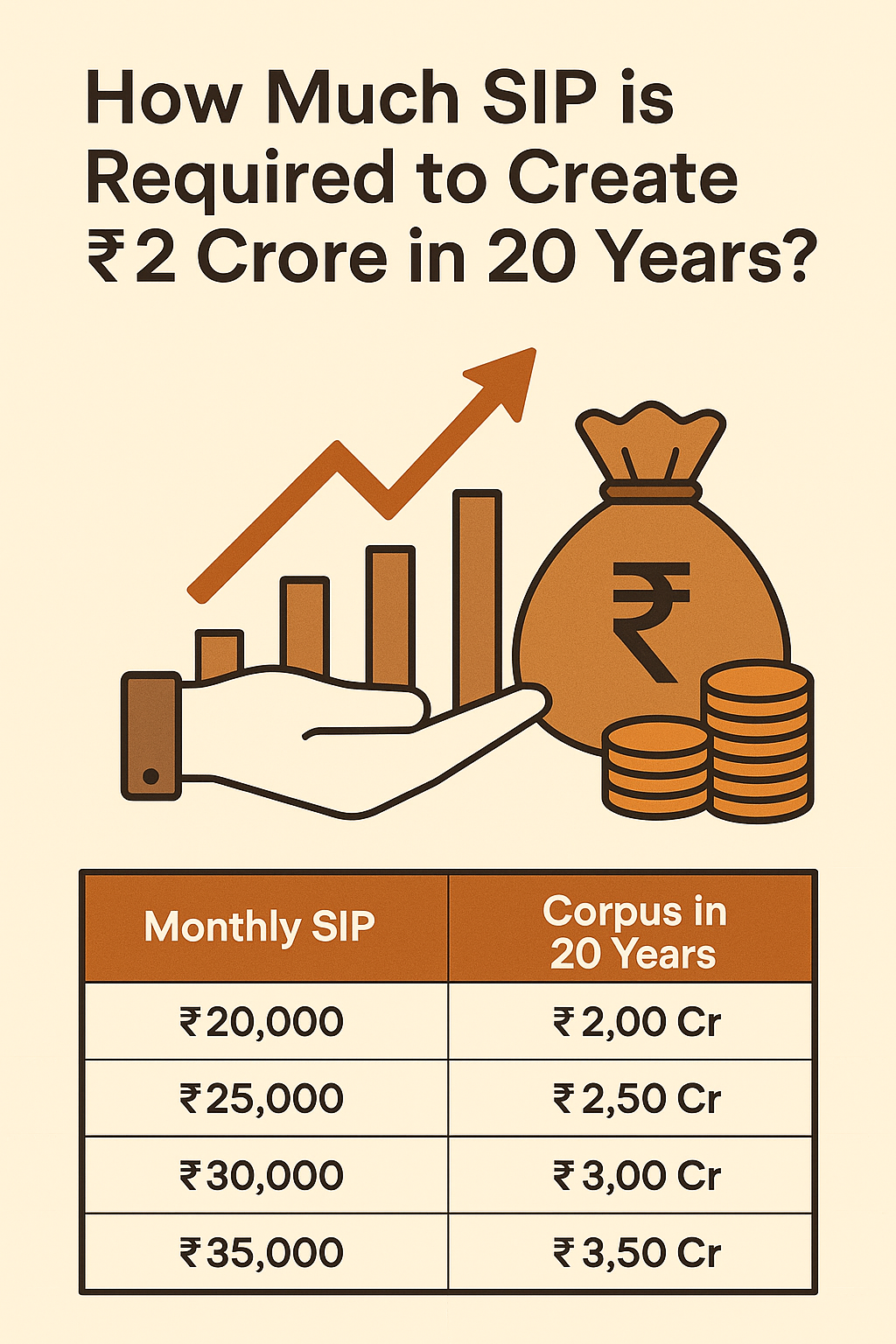

Exact SIP Needed for ₹2 Crore in 20 Years

Assuming an average 12% per annum (long-run equity returns), here is the monthly SIP required and what different amounts can become in 20 years.

| Monthly SIP | Estimated Corpus in 20 Years |

|---|---|

| ₹20,000 | ₹19,982,958 (₹2.00 Cr) |

| ₹25,000 | ₹24,978,698 (₹2.50 Cr) |

| ₹30,000 | ₹29,974,438 (₹3.00 Cr) |

| ₹35,000 | ₹34,970,177 (₹3.50 Cr) |

Rule of thumb: To target ₹2 crore in 20 years at 12% p.a., you need a SIP of roughly ₹20,000 per month. Learn how to use a SIP Top-Up to start lower and still reach the goal.

Model Allocation for a 25–30-Year-Old

Core Growth (40%)

Flexi Cap Funds spread across large, mid, and small caps for balanced growth.

Focused Stability (20%)

Large Cap Funds own market leaders—lower volatility over cycles.

High Growth (30%)

Mid Cap Funds add a return kicker; expect fluctuations—stay the course.

Low-Cost Core (10%)

Nifty 50 Index Funds provide broad exposure at minimal cost.

Suggested Mutual Fund Categories (Examples)

- Flexi Cap: Parag Parikh Flexi Cap Fund, HDFC Flexi Cap Fund

- Large Cap: ICICI Prudential Bluechip Fund, SBI Bluechip Fund

- Mid Cap: Kotak Emerging Equity Fund, Axis Midcap Fund

- Index: UTI Nifty 50 Index Fund, HDFC Nifty 50 Index Fund

- Aggressive Hybrid (optional): ICICI Prudential Equity & Debt Fund, HDFC Hybrid Equity Fund

These are category examples, not investment advice. Check expense ratio, rolling returns, fund manager tenure, and your risk profile. Prefer a SEBI-registered advisor—talk to us.

Action Plan You Can Start Today

- Start a SIP of ₹20,000 across 3–4 funds as per the model mix.

- Enable a 10% SIP top-up yearly (align with salary increments).

- Keep an Emergency Fund of 6 months expenses in liquid/overnight funds.

- Review annually: rebalance to target weights; avoid reactionary exits.

- Stay invested for the full 20 years—time in the market beats timing.

FAQs: SIP for Child Education & Marriage

How much should I invest monthly to build ₹2 crore in 20 years?

About ₹20,000 per month at a 12% expected return.

Which mutual funds are best for a 20-year SIP?

A mix of Flexi Cap, Large Cap, Mid Cap, and Nifty 50 Index funds from reputed AMCs with low costs and consistent performance.

Is 12% guaranteed?

No—equity returns fluctuate. Diversification and staying invested matter most over long horizons.

SIP Mutual Funds Child Education

20-Year SIP to ₹2 Crore: Complete Guide for Young Parents

If you’re 25–30 and planning for your child’s higher education and marriage, this guide shows the exact monthly SIP to target ₹2 Crore in 20 years—plus fund categories and a model allocation.

Why a 20-Year Horizon Matters

Compounding thrives on time. Education costs that are ₹25 lakh today can reach ₹80 lakh–₹1 crore in two decades. Wedding budgets of ₹20 lakh can grow to ₹60–70 lakh. Targeting a ₹2 crore corpus helps you cover higher studies, overseas education, and marriage without debt.

Run your numbers with our SIP Calculator or contact us.

Exact SIP Needed for ₹2 Crore in 20 Years

- ₹20,000/month → approx corpus after 20 years

- ₹25,000/month → higher corpus

- ₹30,000/month → higher corpus

- ₹35,000/month → higher corpus

Rule of thumb: To target ₹2 crore in 20 years at 12% p.a., aim for about ₹20,000 per month. Use a SIP Top-Up to start lower and still reach the goal.

Model Allocation for a 25–30-Year-Old

- Flexi Cap (40%) — Core growth

- Large Cap (20%) — Stability

- Mid Cap (30%) — Growth kicker

- Index (10%) — Low-cost core

Suggested Mutual Fund Categories (Examples)

- Flexi Cap: Parag Parikh Flexi Cap Fund, HDFC Flexi Cap Fund

- Large Cap: ICICI Prudential Bluechip Fund, SBI Bluechip Fund

- Mid Cap: Kotak Emerging Equity Fund, Axis Midcap Fund

- Index: UTI Nifty 50 Index Fund, HDFC Nifty 50 Index Fund

- Aggressive Hybrid (optional): ICICI Prudential Equity & Debt Fund, HDFC Hybrid Equity Fund

FAQs

Q: How much should I invest monthly to build ₹2 crore in 20 years?

A: About ₹20,000 per month at a 12% expected return.

Q: Which mutual funds are best for a 20-year SIP?

A: A mix of Flexi Cap, Large Cap, Mid Cap, and Nifty 50 Index funds from reputed AMCs.

Disclaimer: This content is educational and not investment advice. Mutual fund investments are subject to market risks.